MCF Goes Commercial: Key Figures and Market Momentum

- Nguyen Tran Tien

- Oct 13, 2025

- 2 min read

Here’s a tighter, data-driven view of where MCF stands commercially and how fast it’s growing:

Market Size & Growth Projections

According to QYResearch, the global MCF market was valued at about USD 5.84 million in 2024, and is forecast to expand to around USD 36.98 million by 2031 — implying a compound annual growth rate (CAGR) of ~29.9 %.

In contrast, some broader estimates see the multicore fiber optics sector (which may include other variants) at USD 1.5 billion in 2024, reaching USD 3.2 billion by 2033, at a CAGR of ~9.2 %.

DataIntelo similarly forecasts the market rising from ~USD 2.5 billion in 2023 to over USD 8 billion by 2032 in the multicore fiber optics domain.

Market Structure & Segmentation

In the MCF market, the top three manufacturers already account for about 79 % of global revenues as of 2024.

The 4-core MCF design holds the largest product share — around 55.7 % of MCF units sold.

By application, communication (telecom / data networks) dominates, with about 74.7 % share of MCF use.

Supporting Markets & Ecosystem Elements

The MCF fanouts market (i.e. devices that split or branch core outputs) is already active: in 2024, its market size was about USD 0.09 billion, with projections rising to ~USD 0.17 billion by 2033 (CAGR ~6.7 %).

In the general optical fiber / fiber optics markets, we see strong tails: e.g. the optical fiber market is projected to grow from ~US$ 9.32 billion in 2022 to US$ 18.76 billion by 2030 (CAGR ~9.1 %).

Also relevant: within the fiber component domain (connectors, transceivers, splitters, etc.), the market is forecast to grow at ~9.8 % per year from 2025 to 2030.

Commercial Challenges & Technology Signals

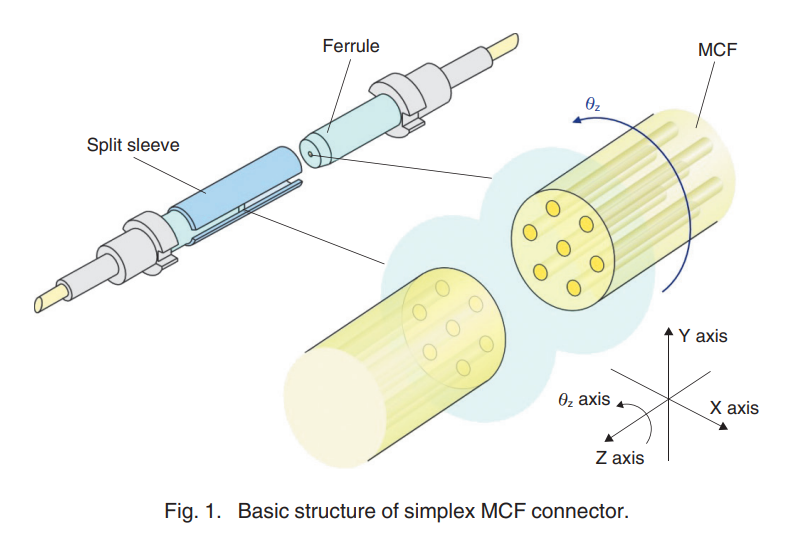

MCF commercialization still faces hurdles in crosstalk suppression, precise splicing/connector technologies, and compatibility with single-core fiber networks.

Some technical breakthroughs are emerging: for example, NTT and Hokkaido University demonstrated a new structural MCF design capable of >10× spatial multiplexing (i.e. >10 cores with low delay differences) while maintaining fiber diameter constraints.

These advances are important because they reduce the gap between lab innovations and deployable commercial systems.

Comments